Sign up to our newsletter

Research Coverage

April 2020

Important Information:

This webinar contains information specifically intended for institutional clients, asset consultants, advisers, platforms and researchers, who are professional investors and wholesale clients (as defined in the Corporations Act 2001).

I confirm that I am a professional or wholesale investor as defined by the Corporations Act 2001 and wish to proceed.

Given the heightened market volatility and continued uncertainty, we provide our perspectives on recent global equity events, the outlook for corporate earnings, and how we are positioning our global small and mid-cap strategy in light of this.

Global equity perspectives

The outlook for investors has changed dramatically since the start of the year and will likely continue to shift moving forward. The associated shocks of the severe dislocation in global markets resulting from COVID-19 has many investors concerned about the prospect of lower dividends and muted growth expectations from equity holdings, as well as the state of the economy as a whole.

As we look into the rest of 2020, we do think we will experience a global recession and materially lower earnings per share in 2020 versus that of 2019 (30-50%). Unlike the GFC – this crisis is much more widespread and consumer focused. In the US economy alone, the consumer accounts for 70% of GDP – so the lockdown has a material impact on the GDP of the US, which means we are going to see negative economic growth but not only in the US, we believe in Europe and Asia also. On a positive note, Governments around the world have acted swiftly to provide a huge amount of stimulus into economies which will eventually help to kick start the economic re-opening, but it will possibly be somewhat slower than many would hope – more likely 2021 rather than the second half of 2020.

We believe this has been a ‘value led’ drawdown − as the crisis has exposed the financial vulnerabilities of companies that exhibit varying combinations of cyclical earnings, poor pricing power, capital intensity and balance sheet weakness. Sectors that have already experienced weaker earnings outlooks include Energy, Financials, Cyclical Industrials, Hospitality and selective Retail. Earnings downgrades globally still have a long way to play out as US corporates report earnings through April/May.

Balance sheet strength is paramount

Balance sheet strength has become a key focus for investors and many companies have been ‘found out’ as a result of COVID-19. There has been a mad scramble by some companies to shore up their balance sheets by drawing down existing lines of credit and capital raisings. Those that survive will take many years to recover and many businesses will, unfortunately, not see the other side of this.

‘Quality’ counts in a crisis

Investment philosophies and styles vary, and many active managers focus on high quality companies in the stock selection process. It is our experience and belief that high quality businesses with low levels of debt have the potential not only to provide superior risk-adjusted returns, but they may also exhibit defensive characteristics in times of market volatility. We expect that ‘Quality’ as a style will generate material alpha in the current COVID-19 dominated environment.

Early in the downturn, higher quality companies were outperforming and this crisis has been quick to unmask inherent financial frailty of companies that exhibit a combination of stretched balance sheets, capital intensive businesses and economically sensitive earnings. We believe this trend should continue through the economic slump and in the early stages of the recovery – providing opportunities for investors.

Global equities earnings outlook for 2020

Global corporate earnings are expected to collectively fall by 30-50% this year – the magnitude of the falls will differ materially based on the ‘quality’ of the businesses with many of the ‘value’ stocks having material earnings downside risk which could be expected to worsen, as we have just come off the starting line of reporting season. Growth stocks are still very vulnerable to slowing growth and multiple compression. Further, the earnings decline in the businesses that we hold in the global small and mid cap (SMID) strategy will be materially lower than that of the market as a whole. Our Quality at a Reasonable Price or QARP style (investing in high quality businesses while not overpaying for them) means our valuation discipline has and will continue to hold us in good stead for the next 12-24 months. As the market experiences further weakness, there are a number of opportunities in the first quarter that we have been following and we will likely see more eventuate through 2020.

Discovering opportunities in uncovered places

As we live through this turbulent time, we believe this year will be a very good opportunity to make allocations to quality global SMID cap companies. Valuations are currently very attractive, the MSCI World SMID Forward P/E is 14.1x vs its ten year average of 16.6x (i.e. ~15% discount). This also means there is much less valuation risk than large cap growth companies which performed well in 2019, with the MSCI World Growth Index Forward P/E at 19.8x (as at March 2020).

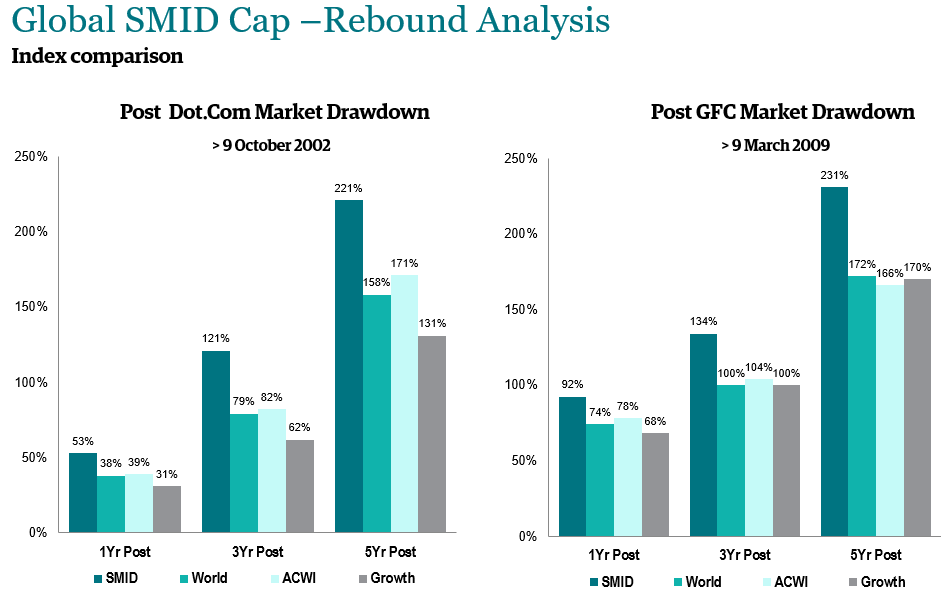

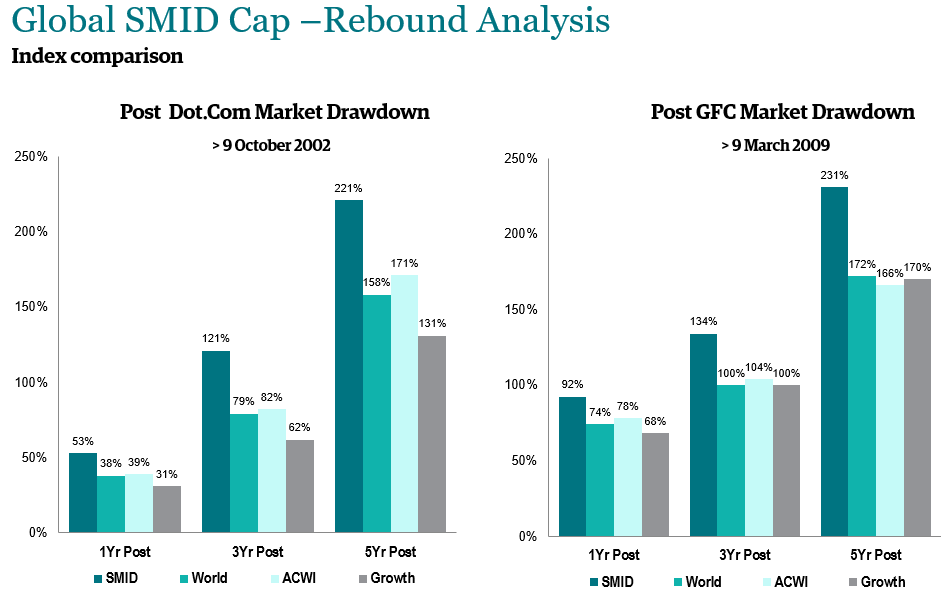

We believe global SMID cap stocks are due for a rebound

The economic recovery post COVID-19 will have material positive impact on SMID cap corporate earnings, as history has shown us. SMID cap equities tend to beat large caps after the market bottoms, outperforming larger stocks in the year following a recession. A rebound in these SMID cap names would also offer another tailwind from 2021 and beyond. For long term investors, this represents a once-in-a-10-year opportunity to invest in some of the best quality global companies at very attractive prices among SMID stocks.

Source: Bloomberg. In USD, 3 year and 5 year post cumulative performance. Indices detailed. MSCI World SMID (SMID), MSCI World (World), MSCI World ACWI (ACWI), MSCI Growth (Growth).

Past performance is no guarantee of future performance.

The long game: Global SMID strategy portfolio positioning

Overall, we feel we have been able to incrementally improve the quality of the portfolio through several switches in the first quarter of 2020. We have also introduced several of the highest quality names from our watchlist at attractive prices. Our trading activity through the first quarter of 2020 has been driven by several overall themes such as:

As the market begins to stabilise and eventually recover, as an active manager we believe we are well positioned for what lies ahead. More specifically, we believe our investment process should serve investors well in this type of environment and beyond.

Important Information:

Bell Asset Management Limited (BAM) ABN 84 092 278 647, AFSL 231091 does not warrant the accuracy, reliability or completeness of the information. This report has been prepared by BAM for information purposes only and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. No representation or warranty, express or implied, is made as to the accuracy, completeness or reasonableness of any assumption contained in this report. Past performance is not necessarily indicative of expected future performance.

Given the heightened market volatility and continued uncertainty, we provide our perspectives on recent global equity events, the outlook for corporate earnings, and how we are positioning our global small and mid-cap strategy in light of this.

Global equity perspectives

The outlook for investors has changed dramatically since the start of the year and will likely continue to shift moving forward. The associated shocks of the severe dislocation in global markets resulting from COVID-19 has many investors concerned about the prospect of lower dividends and muted growth expectations from equity holdings, as well as the state of the economy as a whole.

As we look into the rest of 2020, we do think we will experience a global recession and materially lower earnings per share in 2020 versus that of 2019 (30-50%). Unlike the GFC – this crisis is much more widespread and consumer focused. In the US economy alone, the consumer accounts for 70% of GDP – so the lockdown has a material impact on the GDP of the US, which means we are going to see negative economic growth but not only in the US, we believe in Europe and Asia also. On a positive note, Governments around the world have acted swiftly to provide a huge amount of stimulus into economies which will eventually help to kick start the economic re-opening, but it will possibly be somewhat slower than many would hope – more likely 2021 rather than the second half of 2020.

We believe this has been a ‘value led’ drawdown − as the crisis has exposed the financial vulnerabilities of companies that exhibit varying combinations of cyclical earnings, poor pricing power, capital intensity and balance sheet weakness. Sectors that have already experienced weaker earnings outlooks include Energy, Financials, Cyclical Industrials, Hospitality and selective Retail. Earnings downgrades globally still have a long way to play out as US corporates report earnings through April/May.

Balance sheet strength is paramount

Balance sheet strength has become a key focus for investors and many companies have been ‘found out’ as a result of COVID-19. There has been a mad scramble by some companies to shore up their balance sheets by drawing down existing lines of credit and capital raisings. Those that survive will take many years to recover and many businesses will, unfortunately, not see the other side of this.

‘Quality’ counts in a crisis

Investment philosophies and styles vary, and many active managers focus on high quality companies in the stock selection process. It is our experience and belief that high quality businesses with low levels of debt have the potential not only to provide superior risk-adjusted returns, but they may also exhibit defensive characteristics in times of market volatility. We expect that ‘Quality’ as a style will generate material alpha in the current COVID-19 dominated environment.

Early in the downturn, higher quality companies were outperforming and this crisis has been quick to unmask inherent financial frailty of companies that exhibit a combination of stretched balance sheets, capital intensive businesses and economically sensitive earnings. We believe this trend should continue through the economic slump and in the early stages of the recovery – providing opportunities for investors.

Global equities earnings outlook for 2020

Global corporate earnings are expected to collectively fall by 30-50% this year – the magnitude of the falls will differ materially based on the ‘quality’ of the businesses with many of the ‘value’ stocks having material earnings downside risk which could be expected to worsen, as we have just come off the starting line of reporting season. Growth stocks are still very vulnerable to slowing growth and multiple compression. Further, the earnings decline in the businesses that we hold in the global small and mid cap (SMID) strategy will be materially lower than that of the market as a whole. Our Quality at a Reasonable Price or QARP style (investing in high quality businesses while not overpaying for them) means our valuation discipline has and will continue to hold us in good stead for the next 12-24 months. As the market experiences further weakness, there are a number of opportunities in the first quarter that we have been following and we will likely see more eventuate through 2020.

Discovering opportunities in uncovered places

As we live through this turbulent time, we believe this year will be a very good opportunity to make allocations to quality global SMID cap companies. Valuations are currently very attractive, the MSCI World SMID Forward P/E is 14.1x vs its ten year average of 16.6x (i.e. ~15% discount). This also means there is much less valuation risk than large cap growth companies which performed well in 2019, with the MSCI World Growth Index Forward P/E at 19.8x (as at March 2020).

We believe global SMID cap stocks are due for a rebound

The economic recovery post COVID-19 will have material positive impact on SMID cap corporate earnings, as history has shown us. SMID cap equities tend to beat large caps after the market bottoms, outperforming larger stocks in the year following a recession. A rebound in these SMID cap names would also offer another tailwind from 2021 and beyond. For long term investors, this represents a once-in-a-10-year opportunity to invest in some of the best quality global companies at very attractive prices among SMID stocks.

Source: Bloomberg. In USD, 3 year and 5 year post cumulative performance. Indices detailed. MSCI World SMID (SMID), MSCI World (World), MSCI World ACWI (ACWI), MSCI Growth (Growth).

Past performance is no guarantee of future performance.

The long game: Global SMID strategy portfolio positioning

Overall, we feel we have been able to incrementally improve the quality of the portfolio through several switches in the first quarter of 2020. We have also introduced several of the highest quality names from our watchlist at attractive prices. Our trading activity through the first quarter of 2020 has been driven by several overall themes such as:

As the market begins to stabilise and eventually recover, as an active manager we believe we are well positioned for what lies ahead. More specifically, we believe our investment process should serve investors well in this type of environment and beyond.

Important Information:

Bell Asset Management Limited (BAM) ABN 84 092 278 647, AFSL 231091 does not warrant the accuracy, reliability or completeness of the information. This report has been prepared by BAM for information purposes only and does not take into consideration the investment objectives, financial circumstances or needs of any particular recipient – it contains general information only. No representation or warranty, express or implied, is made as to the accuracy, completeness or reasonableness of any assumption contained in this report. Past performance is not necessarily indicative of expected future performance.