How We Manage Global Equities

Investment philosophy

Disciplined, consistent, repeatable.

We believe company quality will ultimately drive share prices over time. Accordingly, we aim to create a portfolio of diversified, very high-quality companies. Our long-only strategies are grounded in fundamental, bottom-up research and a high-conviction investment process refined over decades. By staying true to this disciplined, long-term approach, we aim to deliver returns above the benchmark.

QARP Philosophy

We don’t follow traditional ‘growth’ or ‘value’ labels. Instead, we focus on high-quality companies with strong future prospects and disciplined valuation.

Our Quality at a Reasonable Price (QARP) approach is built on a methodical, research-driven process, selecting stocks with strong fundamentals. Our portfolio is unconstrained by benchmark weights, with investments based on merit across multiple factors including quality, valuation, and long-term outlook.

ESG considerations are integrated throughout, as we believe they contribute to better long-term investment outcomes.

Investment Universe

Our investment universe starts with 900 stocks, which are systematically narrowed through our idea generation quality score, fundamental quality assessment, and identification of mispriced quality opportunities — culminating in a portfolio constructed with an optimal blend across the quality spectrum.

We believe company quality will ultimately drive share prices over time. Accordingly, we aim to create a portfolio of diversified, very high-quality companies.

Investment approach

CIO Ned Bell discusses why Bell’s investment approach is focused on bottom-up stock selection with a quality bias, the key differentiators across strategies, and the importance of a valuation discipline to identify disconnection between quality and value.

Investment process

We believe company quality will ultimately drive share prices over time, and as such we aim to identify leaders within their respective sectors. We define a ‘high quality company’ as one with an attractive combination of:

- Quality management

- Consistent profitability

- Franchise strength

- Financial strength

- Favourable business drivers

- Environmental, social and governance

Quantitative

- Filter for ROE > 15% over 3 consecutive years

- Market cap > $1bn

- ESG negative screens

Prioritisation

- Quality score applied

- Measures profitability, growth and financial strength

- Unbiased, disciplined, idea generation

Qualitative

Fundamental test:

pass or fail

- Management

- Franchise Strength

- Profitability

- Financial Strength

- Business Drivers

- ESG

Valuation

- Identify mispriced stocks

- Disconnection between quality & value

Portfolio Construction

- Identifying optimal blend across the entire ‘Quality’ spectrum

- No regional/ sector limits

- Modest turnover

- Target consistent outcomes

- Resilient in falling markets

- Attain strong batting average

- Target higher portfolio ESG rating vs Index

- Carbon intensity at least 25% below benchmark

Establish universe

Core ~ 900

High Conviction ~ 900

SMID ~ 700

Idea generation

~ 450

~ 450

~ 350

Quality test

~ 250

~ 250

~ 150

Holdings

90 ~ 100

30 ~ 50

35 ~ 55

We employ a “bottom-up” stock selection approach to investing in global equities. We consider the MSCI Developed and Emerging Markets as our starting universe and methodically shrink our potential investment universe by applying strict quantitative criteria. Over time, we have found this approach has had the dual benefit of: eliminating poor quality companies from investment consideration, and focusing our research efforts on a smaller and higher quality universe of companies.

Extensive research

Our team’s deep global equities expertise is strengthened by ongoing engagement with companies worldwide, including significant time spent overseas in face-to-face meetings that provide firsthand insight into the businesses we research and ultimately invest in. We conduct more than 500 company meetings each year, ensuring continuous, direct access to management teams and a deep understanding of our investment universe.

ESG philosophy

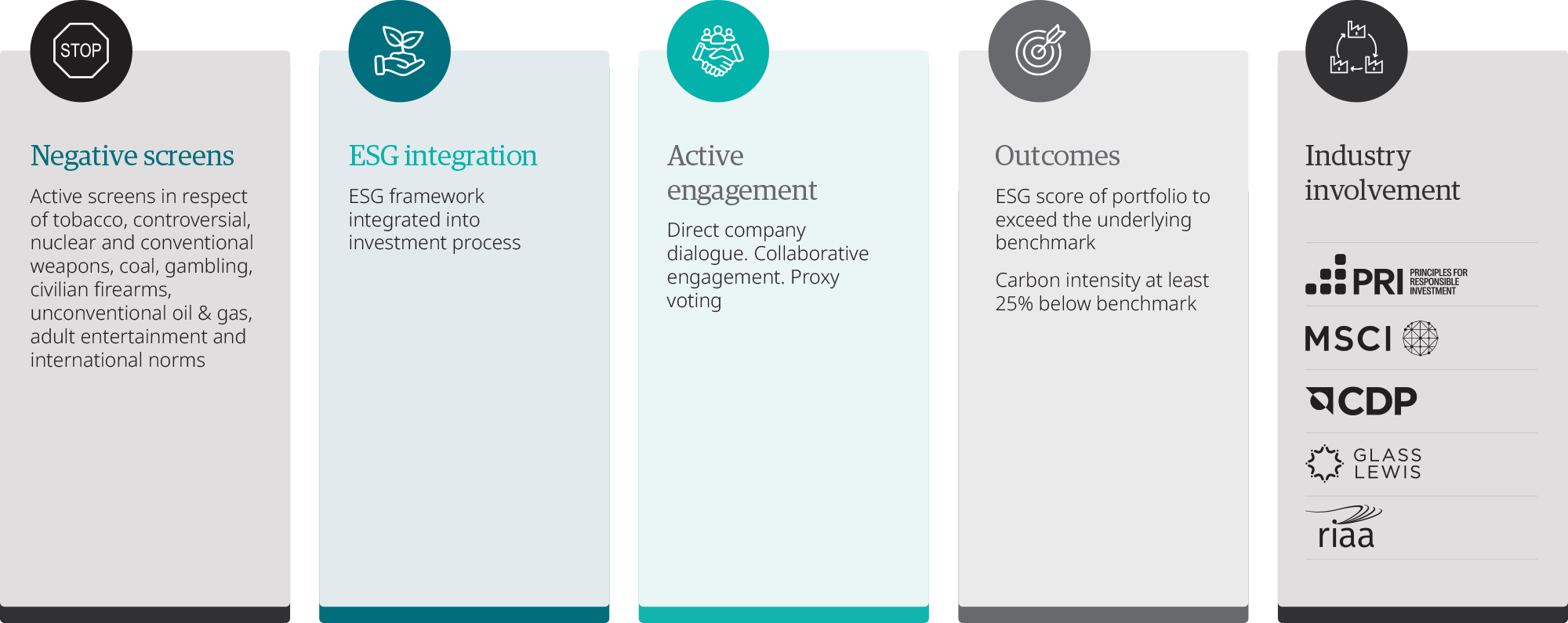

Bell Asset Management employs a robust and ongoing commitment towards integrating Environmental, Social and Governance (ESG) issues within our investment process. We employ a disciplined investment framework combined with stewardship and ESG-specific activities including ESG screening, ESG analysis, active engagement, and proxy voting with companies in all of our portfolios.

We believe that integrating ESG factors into our investment process will deliver superior long-term returns. As stewards of our clients’ capital, we believe active ownership and engagement is in the best interests of our investors.

ESG policies & reports

Documents below are available for download: